DGCX Year-on-Year Growth up over 20%; Additional Base Metals Product Launch Highly Successful

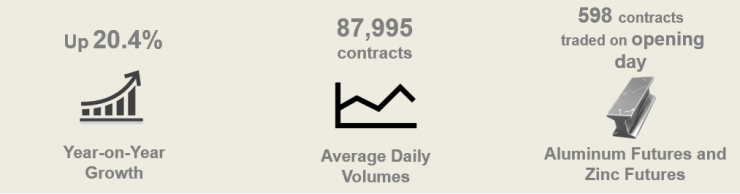

Building on its existing portfolio of metals products, the Dubai Gold & Commodities Exchange (DGCX) successfully launched two new contracts, Aluminium Futures and Zinc Futures on 22nd March 2019. The products have been very well received by investors and traded a combined total of 598 lots on their opening day.

Les Male, CEO of DGCX, said: “These new products were developed after close consultation with our members and market participants, and are the first Aluminium and Zinc Futures to be launched in the GCC. We are delighted they have received such a great response, as we grow regionally and expand internationally widening participation and increasing our member base. These contracts are particularly appealing to global clearers, metal producers and finance houses so we are confident that they will see significant growth in trading activity over the next few months.”

All trades in the new contracts are cleared by the DGCX’s wholly-owned and regulated clearing house, the Dubai Commodities Clearing Corporation (DCCC), which is recognized by the European Securities and Markets Authority as a third-country central counterparty.

“The consistent growth of our product suite and trading volumes is a key measure of our recent success and comes as a direct result of our expanding member community. Moving forward, we will continue to focus on being a member-led exchange, introducing innovative products and solutions that meet the growing needs of our investors,” Male added.

The size of each Aluminium Futures and Zinc Futures contract is 5 metric tons (MT), denominated and traded in US dollars.

Trading Activity in March 2019

The DGCX recorded 20.4% year-on-year (Y-o-Y) growth in March, trading over 1.84 million contracts with a notional value of over USD 36.6 billion. Average Daily Volumes (ADV) throughout the same month also increased, registering 87,995 contracts.

-Ends-

About DGCX: Established in 2005, DGCX is the region’s leading derivatives exchange and the only one allowing global participants to trade, clear and settle transactions within the Gulf region. The Exchange has played a pioneering role in developing the regional market for derivatives and financial infrastructure. DGCX is an electronic commodity and currency derivatives exchange with over 200 members from across the globe, offering futures and options contracts covering the precious metals, energy, equities and currency sectors. DGCX is a subsidiary of DMCC (Dubai Multi Commodities Centre), a Dubai Government Authority for trade, enterprise and commodities. For more information: www.dgcx.ae

DGCX also owns and operates the region’s largest and only multi-asset Clearing House – Dubai Commodities Clearing Corporation (DCCC). DCCC is federally regulated by the Securities & Commodities Authority (SCA) and is recognized as a Third-Country CCP by European Securities Markets Authority (ESMA) with over 90 clearers from across the globe. For more information: www.dccc.co.ae

Further Information:

Jonathan Fisher

Weber Shandwick PR

Tel: +971 (0) 4 445 4222

Email: JFisher@webershandwick.com