DGCX Records Best April Since Inception with Uptick in Indian Rupee and G6 Currencies Trading

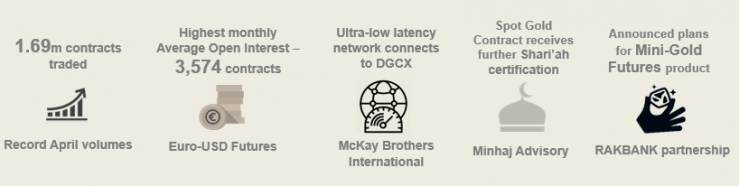

The Dubai Gold & Commodities Exchange (DGCX) achieved its best April performance since inception, with overall volumes reaching 1,696,877 contracts, valued at USD 32.29 billion. Last month’s record-breaking performance was largely driven by an uptick in Indian Rupee (INR) trading fuelled by India’s upcoming elections, as well as ongoing geopolitical tensions across Europe, the United States, and Asia, which have helped maintain elevated volumes in other contracts across the Exchange.

Additionally, the Indian Rupee Quanto Future, the index pricing of the Indian Rupee US Dollar currency pair, performed well, trading 1,621,202 contracts year-to-date (Y-T-D), up 42.14% year-on-year (Y-O-Y).

Among the G6 Currency pairs, the Euro was the most prominent, recording its highest monthly Average Open Interest (AOI) of 3,574 contracts.

Les Male, CEO of DGCX, commented: “After a strong start to 2019 in which we expanded our portfolio of products and beat previous trading records, we have maintained our momentum into the second quarter. Consistent growth in April’s trading activity in contracts such as the Rupee Quanto Future and Euro indicates that our market participants increasingly rely on the DGCX for hedging and investment purposes, while other developments such as our new connection to an ultra-low latency network demonstrates our ongoing commitment to meet the needs of investors.

Last month the DGCX connected to a new ultra-low latency network through McKay Brothers International, a leading provider of microwave-based private bandwidth and market data services. The network further lowers the speed of transactions between the DGCX and major European and US trading hubs, enhancing its offerings to existing members, market participants and new entrants.

“We have a lot more activity planned for the rest of the year as we widen participation and further expand our member community. We particularly look forward to the launch of MENA’s first exchange-listed Mini-Gold Product in partnership with RAKBANK, which will add another dynamic layer to our product offering.”

Further underscoring a particularly busy month, the DGCX in April received a new Shari’ah certification for its Shari’ah Compliant Spot Gold contract (DGSG). The Shari’ah Pronouncement (Fatwa) was issued by Minhaj Advisory, a leading Dubai-based Islamic advisory firm, and determined that DGSG meets all the necessary Shari’ah requirements in line with Islamic rules and principles.

-Ends-

About DGCX: Established in 2005, DGCX is the region’s leading derivatives exchange and the only one allowing global participants to trade, clear and settle transactions within the Gulf region. The Exchange has played a pioneering role in developing the regional market for derivatives and financial infrastructure. DGCX is an electronic commodity and currency derivatives exchange with over 200 members from across the globe, offering futures and options contracts covering the precious metals, energy, equities and currency sectors. DGCX is a subsidiary of DMCC (Dubai Multi Commodities Centre), a Dubai Government Authority for trade, enterprise and commodities. For more information: www.dgcx.ae

DGCX also owns and operates the region’s largest and only multi-asset Clearing House – Dubai Commodities Clearing Corporation (DCCC). DCCC is federally regulated by the Securities & Commodities Authority (SCA) and is recognized as a Third-Country CCP by European Securities Markets Authority (ESMA) with over 90 clearers from across the globe. For more information: www.dccc.co.ae

Further Information:

Jonathan Fisher

Weber Shandwick PR

Tel: +971 (0) 4 445 4222

Email: JFisher@webershandwick.com