DGCX Registers Highest Ever Quarterly Volumes

Exchange breaks all-time quarterly volumes record

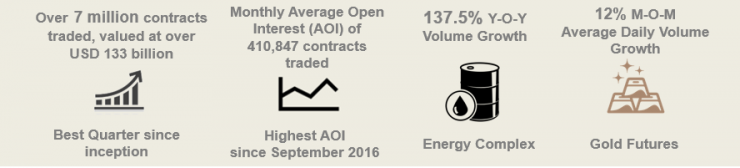

The Dubai Gold and Commodities Exchange (DGCX) has continued its record-breaking performance this year, registering its best quarter since inception with over 7.98 million contracts traded in the third quarter of 2019, with over 2.37 million contracts traded in September, valued at USD 41 billion.

The Exchange also recorded a monthly Average Open Interest (AOI) of 410,847 contracts in September, its highest AOI since September 2016. Average Daily Volumes (ADV) in September reached 112,988 per day, up 20% year-on-year (Y-O-Y).

Last month’s success was primarily driven by the DGCX’s Indian Rupee (INR) product suite. Building on its record successes in August, the INR Quanto Futures contract was the standout performer once again, with the index pricing of the Indian Rupee US dollar currency pair concluding last quarter from July to September with more than 3.78 million contracts traded. INR Mini Futures also performed strongly, registering its highest ever monthly AOI of 122,003 contracts.

DGCX also recorded a sharp uptake in its Energy portfolio last month, with Brent Crude Oil Futures and West Texas Intermediary (WTI) Futures recording Y-O-Y growth of 154% and 121% respectively. Meanwhile, the Exchange’s flagship Gold Futures product in September recorded month-on-month (M-O-M) average daily volume growth (ADV) of 12%.

Les Male, CEO of DGCX, commented: “DGCX’s recent record volume growth and open interest records reflect the strength and depth of our offerings, and increased investor confidence in the Exchange. Last month’s achievements were driven by ongoing geo-political instability, including continued uncertainty surrounding Brexit and the US and China trade war.

“Moving into the last quarter of the year, we will continue to focus on growing our membership base and expanding our footprint, and we are optimistic that we will keep our momentum going, enabling an increasing number of investors to hedge their risks during periods of volatility.”

About DGCX: Established in 2005, DGCX is the region’s leading derivatives exchange and the only one allowing global participants to trade, clear and settle transactions within the Gulf region. The Exchange has played a pioneering role in developing the regional market for derivatives and financial infrastructure. DGCX is an electronic commodity and currency derivatives exchange with over 200 members from across the globe, offering futures and options contracts covering the precious metals, energy, equities and currency sectors. DGCX is a subsidiary of DMCC (Dubai Multi Commodities Centre), a Dubai Government Authority for trade, enterprise and commodities. For more information: www.dgcx.ae

DGCX also owns and operates the region’s largest and only multi-asset Clearing House – Dubai Commodities Clearing Corporation (DCCC). DCCC is federally regulated by the Securities & Commodities Authority (SCA) and is recognized as a Third-Country CCP by European Securities Markets Authority (ESMA) with over 90 clearers from across the globe. For more information: www.dccc.co.ae

Further Information:

Jonathan Fisher

Weber Shandwick PR

Tel: +971 (0) 4 445 4222

Email: JFisher@webershandwick.com