DGCX Records Highest Average Daily Volumes

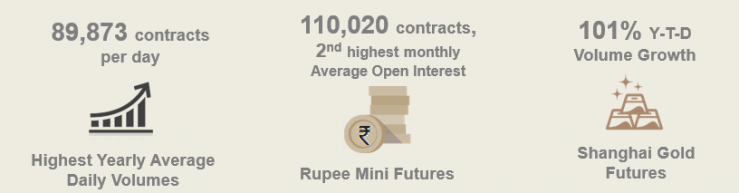

Total volumes on the Dubai Gold & Commodities Exchange (DGCX) this year hit 17,255,556 contracts at the end of September, with yearly Average Daily Volumes (ADV) at their highest ever, reaching 89,873 contracts per day.

The best performing asset class in September was the Indian Rupee (INR) product suite, which saw Rupee Mini Futures record its 2ndhighest monthly Average Open Interest (AOI) of 110,020 contracts, and the Indian Rupee Quanto, which has traded 3,160,471 contracts year-to-date (Y-T-D), up 51% from 2017.

Trading in September was also underpinned by the Indian Single Stock Futures (SSF) and Shanghai Gold Futures (DSGC), which registered Y-T-D volume growth of 195% and 101% respectively.

Les Male, CEO of DGCX, commented:“The rising popularity of INR trading this month follows the continued depreciation of the rupee, which has seen investors turn to more regulated markets to hedge their exposure to the US dollar. The robust performance of our Rupee Mini Futures, in particular, is of note, with its increasing liquidity and depth of market, it is testament to the smaller sized contract’s ability to enable retail remitters, individual investors and SMEs to cost-effectively manage their currency risk.”

The DGCX is participating in the upcoming World Investor Week 2018 (WIW) from the 1-7 October 2018. WIW is a global campaign promoted by the International Organization of Securities Commissions (IOSCO) to raise awareness about the importance of investor education and protection and highlight the various initiatives of securities regulators in these two critical areas. DGCX will be participating in conjunction with the Securities and Commodities Authority (SCA) on numerous events throughout the week.

-Ends-

About DGCX: Established in 2005, DGCX is the region’s leading derivatives exchange and the only one allowing global participants to trade, clear and settle transactions within the Gulf region. The Exchange has played a pioneering role in developing the regional market for derivatives and financial infrastructure. DGCX is an electronic commodity and currency derivatives exchange with over 175 members from across the globe, offering futures and options contracts covering the precious metals, energy, equities and currency sectors. DGCX is a subsidiary of DMCC (Dubai Multi Commodities Centre), a Dubai Government Authority for trade, enterprise and commodities. For more information: www.dgcx.ae

DGCX also owns and operates the region’s largest and only multi-asset Clearing House – Dubai Commodities Clearing Corporation (DCCC). DCCC is federally regulated by the Securities & Commodities Authority (SCA) and is recognized as a Third-Country CCP by European Securities Markets Authority (ESMA) with over 80 clearers from across the globe. For more information: www.dccc.co.ae

Further Information:

Jonathan Fisher

Weber Shandwick PR

Tel: +971 (0) 4 445 4222

Email: JFisher@webershandwick.com