DGCX Records Its Highest-Ever Daily Volume and Sees Growth in Euro Futures Trading Amidst Volatility Spikes

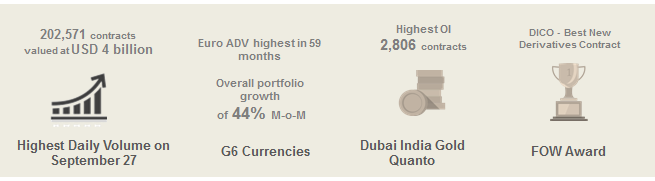

Dubai, October 01, 2017: The Dubai Gold and Commodities Exchange (DGCX), the region’s largest and most diversified derivatives bourse, recorded its highest ever daily volume on September 27, trading 202,571 contracts with a notional value of USD 4 billion. Amidst spikes in market volatility following months of relative calm, monthly volumes also reached their highest ever in September, with 1.87 million lots transacted, and an all-time high Average Daily Volume (ADV) record of 93,604 contracts.

Volumes in the G6 currency portfolio are up 44% from August. In particular, the Euro and British Pound futures contracts performed extremely well, recording impressive month-on-month growth of 67% and 19% respectively. The Euro has traded its highest volume with 172,291 contracts so far this year, while the British Pound recorded its highest average Open Interest (OI) of 832 contracts. Additionally, the Exchange’s innovative product offering, Indian Single Stock Futures (SSFs) witnessed growth of 14% month-on-month.

In the precious metals segment, the Exchange’s flagship Gold contract; Dubai Gold, achieved its highest Average OI since 2012. Meanwhile, the Dubai India Gold Quanto recorded its highest OI of 2,806 contracts on September 11, 2017.

Gaurang Desai, CEO of DGCX, commented: “September was a notable month for DGCX, and we thank our members, customers, and partners for their constant support. Not only did we achieve our highest-ever monthly average daily volume, which is a proud and exciting moment for us, but we collectively continued to push the envelope. This includes our recent tie-up with the Market Data Connect service making DGCX contracts ever more accessible to traders in London and being recognized for pioneering contracts that provide significant value to investors and traders. As the largest derivatives Exchange in the region, our endeavor is to improve our capabilities and provide innovative offerings which will support DGCX market participants to make well-informed decisions amid any market situation.”

At the recently held FOW & Global Investor Asia Capital Markets Awards in Singapore, DGCX won accolades for its Dubai India Crude Oil Futures (DICO) contract, which was voted as the ‘Best New Derivatives Contract’. This is the second year in a row that DGCX has received this award, recognized by industry partners and peers worldwide.

Gaurang concluded: “We are working towards launching the region’s first Sharia Spot Gold product, which will help us to meet the latent demand amongst regional traders, as well as take a major step forward in establishing Dubai and the UAE as a world-leading Islamic Finance hub.”

About DGCX: Established in 2005, DGCX is the region’s leading derivatives exchange and the only one allowing global participants to trade, clear and settle transactions within the Gulf region. The Exchange has played a pioneering role in developing the regional market for derivatives and financial infrastructure. DGCX is an electronic commodity and currency derivatives exchange with over 200 members from across the globe, offering futures and options contracts covering the precious metals, energy, equities and currency sectors. DGCX is a subsidiary of DMCC (Dubai Multi Commodities Centre), a Dubai Government Authority for trade, enterprise and commodities. For more information: www.dgcx.ae

DGCX also owns and operates the region’s largest and only multi-asset Clearing House – Dubai Commodities Clearing Corporation (DCCC). DCCC is federally regulated by the Securities & Commodities Authority (SCA) and is recognized as a Third-Country CCP by European Securities Markets Authority (ESMA) with over 90 clearers from across the globe. For more information: www.dccc.co.ae

Further Information:

Meng Chan Shu

Director of Business Development and Sales

Dubai Gold and Commodities Exchange

Tel: +971 4 361 1660

Email: meng.shu@dgcx.ae

or

Dhanya Issac/Lara Batato

Weber Shandwick PRs

Tel: +971 4 445 4222

Email: lbatato@webershandwick.com or lbatato@webershandwick.com